Thank you for your interest in support of the Hop4Kids. To help you facilitate a gift of stock, please use the following three simple steps:

Step 1 - Initiate the Stock Transfer

Securities can be gifted to the Hop4Kids in two ways: either via electronic transfer (in which your broker transfers shares using the Hop4Kids DTC number) or by physically mailing the paper certificates to the Hop4Kids. Either method is acceptable, but it is necessary for you to contact your broker to initiate the transfer. Click here to download a sample letter » for your use.

Step 2 - Notify the Hop4Kids by Filling Out the Form Below

Step 3 - Send the Securities to the Hop4Kids

If Sending Electronically:

Ask your broker to donate through TD Ameritrade.

TD Ameritrade

DTC Number: 0188

ACCT Name: Hop4Kids (Tax ID# 83-1563216)

ACCT Number: 497453582

If Sending by Registered Mail:

Mail your UNENDORSED certificate(s) with a Stock Power Form by registered mail, to:

Hop4Kids

Attn: Gift Processing Unit

1160 Battery St. E., Ste. 100

San Francisco, CA 94111

NOTE: Certificates already registered in the name of the Hop4Kids do not require either the stock waiver or stock power for execution of the transfer.

How does it work?

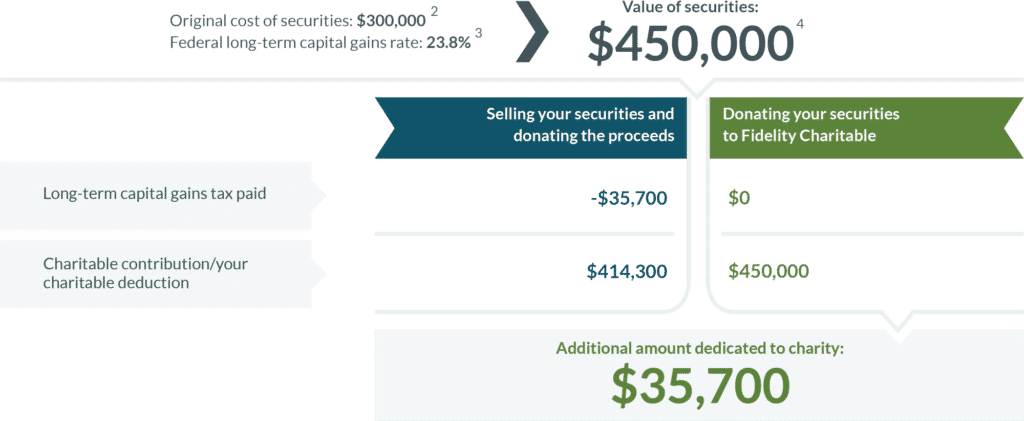

It’s simple and easy. When you donate stock to charity, you’ll generally take a tax deduction for the full fair market value. And because you are donating stock, your contribution and tax deduction may instantly increase over 20%.1 Would you prefer to donate bonds or mutual funds? The same benefits apply.

A larger gift and a larger deduction

Consider this example of donating stock to charity with a Giving Account at Fidelity Charitable:

1This assumes all realized gains are subject to the maximum federal long-term capital gains tax rate of 20% and the Medicare surtax of 3.8%, and that the donor originally planned to sell the stock and contribute the net proceeds (less the capital gains tax and Medicare surtax) to charity.

2Total Cost Basis of Shares is the amount of money you have invested in the shares of a particular fund or individual security. It represents the basic dollar amount that, when compared to the price at which you sell your shares, tells you how much of a capital gain or loss you have realized.

3This assumes all realized gains are subject to the maximum federal long-term capital gains tax rate of 20% and the Medicare surtax of 3.8%. This does not take into account state or local taxes, if any.

4Amount of the proposed donation is the fair market value of the appreciated securities held more than one year that you are considering to donate.

This giving season, please consider making a stock donation to Hop4Kids. Many of our donors have been able to maximize their tax savings, and increase their impact by making a larger gift